14. An Origin of Sustained Growth: R&D I#

The Solow-Swan and Ramsey-Cass-Koopmans models allowed us to identify the proximate or immediate variables causal to economic growth.

In both settings with perfectly competitive markets, short-run growth is driven by capital accumulation. In the long run, the driver is technological progress.

This conclusion remains silent on deeper origins of growth. That is, what drives technological progress itself?

An exception to this would be \(AK\)-type growth models.

14.1. Quick background#

Growth economists classify the \(AK\) class of endogenous growth models as first-generation or early endogenous growth theories.

\(AK\) and effectively \(AK\):

Recall the Cobb-Douglas instance of the Solow-Swan model in Exercise 9.11. If we set the elasticity of output with respect to capital parameter \(\alpha=1\), we recover the original, reduced-form \(AK\) model of Harrod [10] and Domar [8].

Rebelo [23] provides a two-sector model where the investment good is produced using a linear-in-\(K\) or \(AK\) technology. This assumption drives perpetual increases in the capital-labor ratio.

Equilibrium \(AK\):

Lucas [16] and Romer [25] are what we call equilibrium \(AK\) models.

The story in Lucas [16] is one of private accumulation of human capital having an externality on aggregate productivity.

In Romer [25], private accumulation of capital by firms create a public spillover of knowledge or know-how. This is a bit like the idea of technical progress through “learning-by-doing”.

All the reduced-form \(AK\) and equilibrium-determined \(AK\)-type models have these features:

Perpetual or sustained growth.

No transitional dynamics.

Small cross-country differences in saving rates—e.g., by exogenous assumption or as an endogenous response to heterogenous policies—can have huge and permanent differences in living standard and in its growth rate.

The \(AK\)-type models have a deficiency. They imply a counterfactual world distribution of income: The last feature above implies that an \(AK\)-type model would imply a cross-country distribution of income that is too unstable.

Read Chapters 10 to 11 of Acemoglu [1] for further background on this discussion.

14.2. R&D#

We will fast forward a little to study models where Solow-Swan’s blackbox \(A\) will be driven by more fundamental causes.

Fundamental causes and policy channels. Here, we focus on the role of agents’ incentives to invest in R&D. Such purposeful investments then translate to endogenous determination of technological progress. (They will also allow us to identify important channels connecting policies regarding market regulation, competition and intellectual-property rights to technological progress and economic growth.)

Effects of R&D. The basic argument is that R&D changes the set of inputs to production. There are two general approaches to thinking about R&D and its consequences for growth:

Horizontal or expanding-product-variety effects (Product innovation): Here, R&D results in a wider variety of intermediate inputs to production or to a basket of final goods. For example, we can think these effects as having more product varieties; or, this could be more specialization in the production process itself.

Vertical or quality-ladder effects (Process innovation): The operative words here are better product varieties or an improvement in the quality of given varieties. For example, the creation of a computer chip that is faster than its predecessor.

In this part, we focus on R&D that have horizontal or expanding-product-variety effects. This is based on the famous Romer [26] model and its treatment in Acemoglu [1] (Chapter 13).

Micro building blocks

Readers requiring a refresher on the basic—i.e., static and partial-equilibrium—microeconomics of (non-rivalrous) innovation or ideas, monopoly rent, limit pricing and monopolistic competition should work through Chapter 12 of Acemoglu [1].

These will be ingredients crucial to the Romer [26] model and other models of innovation and growth to come.

14.3. Horizontal R&D effects#

The 2018 “Economics Nobel” laureate, Paul M. Romer argues that there are three key things needed for firms to generate new ideas [26]:

Ideas must be non-rival, somewhat like a public good, but they are partially excludable, unlike pure public goods.

Technologically, one can have constant returns to scale in private or firm-specific capital and labor (as in the neoclassical model). However, with the creation of ideas, there is aggregate increasing returns to production.

One needs to depart from perfect competition as a model of market structure: One needs market-power or monopolistic rent to overcome the fixed costs of investment in R&D.

Note

Regarding market power and incentives to innovate, we have these basic insights from microeconomics.

Consider an existing set of competing firms in an industry. They all produce with marginal cost \(\psi\) and face industry demand \(D(p)\), where \(p\) is some market price.

Suppose, Firm 1 pays a fixed cost \(\mu\) to innovate and “wins” by being able to reduce its marginal cost to \(\psi/\lambda < \psi\) (i.e., \(\lambda>1\)). It would become the ex-post monopolist. We have the following cases:

Drastic innovation and pure-monopoly pricing. If the marginal cost is low enough such that the ex-post monopoly price is no larger than the marginal cost of the competitive fringe \(\psi\), i.e., \(p^{M} \leq \psi\), then the winning firm captures the entire market and sets its unconstrained monopoly price:

\[ p^{M} = \underbrace{ \frac{1}{1-1/\epsilon_{D}(p)} }_{\text{Elasticity markup formula}} \times \psi/\lambda, \]where \(\epsilon_{D}(p)\) is the price-elasticity of demand in the market. (Recall, this is the Ramsey monopoly pricing formula from a first course in the microeconomics of monopolies!)

The monopoly profit is

\[ \hat{\pi}_{1}^{I} = \underbrace{D(p^{M})}_{\text{Demand at } p^{M}} \times \left(p^{M} - \psi/\lambda\right) - \mu. \]Under this scenario, the equilibrium social surplus is calculated as

\[ \hat{S}_{1}^{I} = D(p^{M})(p^{M}-\psi/\lambda) + \int_{p^{M}}^{\psi} D(p)dp- \mu. \]Non-drastic innovation and limit pricing. When the innovation of the winning firm does not reduce its marginal cost enough, so that the ex-post monopoly price would exceed the marginal cost of all other firms, \(p^{M} > \psi\), then the innovating firm’s optimal behavior in a Bertrand-pricing Nash equilibrium is to set a limit price: \(p_{1} = \psi\). This is intuitive: At this price, all other firms have no incentive to undercut and the innovating firm will just capture the whole market since it can produce at the lower marginal cost \(\psi/\lambda\) and earn a profit

\[ \pi_{1}^{I} = \underbrace{ D(\psi) }_{\text{Demand at } p_{1}} \times \underbrace{ \psi\left(1-\frac{1}{\lambda}\right) }_{p_{1} - \psi/\lambda} -\mu < \hat{\pi}_{1}^{I}. \]The associated social surplus is

\[ S_{1}^{I} = D(\psi)(\psi-\psi/\lambda) - \mu. \]

Assume that after innovation the product is priced at marginal cost when we consider a social planner’s valuation. Let the social surplus be the sum of all producer surplus (PS) and consumer surplus (CS):

\[\begin{split} \begin{split} S^{I} &= \underbrace{ \int_{\psi/\lambda}^{\psi} \left[ D(p) - D(\psi)\right]dp }_{\text{Increase in CS due to fall in price}} \\ &+ \underbrace{ D(\psi)\psi(1-1/\lambda) }_{\text{Cost reduction from innovation}} \\ &- \underbrace{ \mu }_{\text{Innovation cost}} \end{split} \end{split}\]A social planner would value the innovation more than the ex-post monopoly:

\[ S^{I} > \hat{\pi}_{1}^{I} > \pi_{1}^{I}. \]The social surplus under the monopoly with drastic innovation, \(\hat{S}^{I}_{1}\) dominates that under limit pricing, \(S^{I}_{1}\). The social surplus from innovation (under a planner’s solution), \(S^{I}\) always dominates the total surplus under the monopoly with drastic innovation:

\[ S^{I} > \hat{S}^{I}_{1} > S^{I}_{1}. \]The is called an appropriability effect: A social planner that maximizes consumer and producer surplus will have more incentive to adopt an innovation compared to private firms. Even if a firm has ex-post monopoly rights, it will not fully capture all of the consumer surplus, whereas a planner internalizes all the net social gains from innovation.

An incumbent or ex-ante monopolist always has a lower incentive to innovate than a competitive firm with a view to become an ex-post monopolist. This is because the incumbent monopolist would eat into its existing profit by undertaking more cost reducing innovation. This is known as the replacement effect and is attributed to Arrow [5].

There may be too much innovation due to a business-stealing effect: The profit from innovation of a potential entrant may exceed the social (consumer and producer) surplus under an incumbent monopolist.

The ideas here will go through in the general-equilibrium growth models below.

Let’s look at two models:

Ideas are produced using reproducible resources—final goods or machines: a “lab-equipment model” of Rivera-Batiz and Romer [24].

Ideas are produced using scarce resources—human capital employed in R&D: Romer [26].

14.3.1. Lab equipment model#

Consider a version of such a model where innovation of new products is made using a reproducible—as opposed to scarce—resource: the final good. This model can be found originally in Rivera-Batiz and Romer [24].

Agents. The model has the following actors:

Price-taking representative household who has access to a stock market and owns a balanced portfolio of equity claims on all the firms.

Perfectly competitive final-good producer.

Monopolistically competitive intermediate-goods producers.

Markets. There are markets for:

the final (also, numeraire) good (perfect competition);

intermediate goods (monopolistic competition);

labor market (perfect competition);

stock market for shares in firms (perfect competition).

Production technologies. We leave physical capital out of the story here to emphasize the growth effects from R&D alone.

Final-good production function that requires labor and a basket of intermediate goods.

Ideas or blueprint production using the final good.

Let’s get into the details.

14.3.1.1. Representative household#

There are \(L\) number of households.

Each household supplies a unit of labor inelastically to the labor market at the competitive wage rate of \(w(t)\).

Let \(V(\nu, t)\) denote the equity value of an intermediate-good firm \(\nu\ \in [0, N(t)]\) producing product variety \(\nu\).

Note that a feature we will see later is that \(N(t)\) changes with time so there is an expanding space of product varieties.

We don’t bother with modelling the equity value of the final-good firm since it is perfectly competitive and earns zero profit.

If there is an \(N(t)\) measure of such firms (or varieties) at time \(t\), then the market value of the household’s balanced portfolio of equity claims is \(a(t) := L^{-1}\int_{0}^{N(t)}V(\nu,t)d\nu\).

Since it is a balanced portfolio, the rate of return on holding \(a(t)\) is non-stochastic.

The household’s optimal control problem (OCP) is:

Exercise 14.1 (Hamiltonian)

Write down the Hamiltonian associated with the OCP (14.1).

In an optimal program, we can show that the transversality condition is

Exercise 14.2 (PMP for the household’s OCP)

Show that given market pricing functions, \(t \mapsto (r, w)(t)\), the household optimal consumption or asset accumulation trajectory satisfies the transversality condition (14.2) and:

The Euler-Lagrange equation for intertemporal optimality:

(14.3)#\[ \underbrace{ \rho + \sigma\frac{\dot{c}(t)}{c(t)} }_{\text{Present-value MRS}} = \underbrace{ r(t); }_{\text{Market exchange rate}} \]and,

the flow budget constraint:

(14.4)#\[ \dot{a}(t) = r(t)a(t) + w(t) - c(t). \]Expand further the economic meaning of Equation (14.3) in words your twelve-year-old self could follow.

14.3.1.2. Final good firm#

The perfectly competitive final good firms use \(L\) units of labor and a constant-elasticity-of-substitution (CES) basket of intermediate goods:

\(N(t)\) is the measure of intermediate product varieties to be pinned down in equilibrium.

\(1/\beta \equiv \epsilon_{\beta} > 1\) is the elasticity of substitution between the product varieties.

The final good is produced with the production function:

This is a so-called lab equipment model because the intermediate goods can be interpreted as lab equipment.

We will assume these lab equipment varieties \(x(\nu,t)\) perish immediately after an instance of their employment.

Define:

\(p(\nu,t)\) as the price on an intermediate good \(\nu\) (measured in units of \(Y\)).

\(P(t)\) as the price index of the bundle \(M(t)\). (It is like a Fisher or ideal price index.)

The profit maximization problem of the representative firm can be split into two departments.

Consider a “production and sales” team that takes care of hiring \(M(t)\) and \(L\) inputs to maximize:

\[ AM(t)^{1-\beta}L^{\beta} - P(t)M(t) - w(t)L. \]Since \(A > 0\) is a constant, we can normalize it as \(A \equiv\ (1-\beta)^{-1}\).

Exercise 14.3

Show that the first-order conditions for maximum profit simplify to:

(14.7)#\[ (1-\beta)Y(t) = P(t)M(t), \]and,

(14.8)#\[ \beta\ Y(t) = w(t)L. \]where \(Y(t)\) is given by the production function (14.6).

Note that this gives the familiar insight: Each input, \(L\) or \(M(t)\), is paid its share of total output/income equaling the output elasticity with respect to the input, \(\beta\) or \(1-\beta\).

Now consider a “budget programming” team that equivalently minimizes total cost of constructing bundle \(M(t)\),

(14.9)#\[ \int_{0}^{N(t)} p(\nu,t) x(\nu,t)d\nu \]subject to the engineering constraint (14.5).

Exercise 14.4

Show that the minimizer to this problem is a downward-sloping demand curve for each product variety \(\nu\):

(14.10)#\[ x(\nu,t) = \left[\frac{p(\nu, t)}{P(t)}\right]^{-\frac{1}{\beta}}M(t). \]Hint: The shadow price of the constraint (14.5) is indeed \(P(t)\). (Why?)

Also, derive the cost-minimizing implied price index of the bundle \(M(t)\). Show that it is like an ideal or CES price index:

(14.11)#\[ P(t) = \left[\int_{0}^{N(t)}p(\nu,t)^{1-\frac{1}{\beta}} d\nu\right]^{\frac{1}{1-\frac{1}{\beta}}}. \]

14.3.1.3. Intermediate goods firms#

Each firm, indexed by its unique product variety \(\nu\), has a monopoly in its production.

Suppose each firm has a constant marginal cost of production, \(\psi > 0\).

Firm \(\nu\) sets price \(p(\nu,t)\) to maximize profit:

where the firm takes into account the optimal demand from the final-good firm, so \(x(\nu,t)\) is given by the demand curve (14.10).

Exercise 14.5

Show that the first-order condition yields the familiar monopoly markup-pricing formula:

Recall that the CES price-elasticity of demand is, by construction, constant: \(\epsilon_{\beta} = 1/\beta > 1\).

The pricing markup is thus constant across all varieties \(\nu\): \(1/(1-\beta)>1\).

From (14.13), we have the familiar insight from first-year economics: The monopolist’s markup \(p(\nu,t)/\psi\) is larger the less elastic is demand.

Exercise 14.6

Show that profit at time \(t\) is just proportional to revenue:

Since each \(\nu\)-firm’s optimal decision problem is static, the market valuation of a firm \(\nu\) is just its present-value total stream of static profits:

We can:

14.3.1.4. R&D investment#

Now we are ready to discuss how the number of product varieties, \(N(t)\), is determined.

Any agent can convert one unit of the final good to produce a new blueprint at a Poisson arrival rate of \(\eta>0\). Let \(Z(t)\) be the total units of the final good used for R&D.

An intermediate-good firm that succeeds in creating a new blueprint \(\nu\) has a fully-enforced perpetual patent over that invention.

This allows that firm to produce the product variety \(\nu\) at marginal cost \(\psi\).

By a law of large numbers argument, the total measure of intermediate-product varieties is then determined by

The initial stock of blueprints \(N(0)\) is held by a monopolists with perpetual patents.

14.3.1.5. Free entry#

Entry into R&D is free.

The cost of producing one blueprint is \(1\), measured in units of the final good. The benefit of entry and succeeding at rate \(\eta\)—i.e., \(\eta\) measure of new intermediate-good varieties—yields the payoff \(\eta V(\nu,t)\).

If \(\eta V(\nu,t) < 1\) then there is no incentive to invest in R&D: \(Z(t) = 0\).

If \(\eta V(\nu,t) \geq 1\) then there is entry and thus \(Z(t) > 0\).

Assume that the market value of intermediate producers satisfy \(\eta V(\nu,t)>1\)—i.e., there are strictly positive profits to be made by undertaking R&D.

So then, we can write the free-entry condition in complementary slackness form:

and,

Thus, if there is positive entry in equilibrium, then we can pin down the market value of each intermediary:

This value is constant and is inversely proportional to the arrival rate of new ideas.

14.3.1.6. Competitive equilibrium#

This is a world where some firms have market power. By competitive equilibrium, we mean an equilibrium where all agents are optimizing and all markets clear—i.e., demand equals supply in all markets.

Definition 14.1 (Competitive equilibrium)

Given an initial measure of product varieties \(N(0)\), a competitive equilibrium for \(t \in [0,\infty)\) is a path of

allocations, \(t \mapsto (c, M, Z)(t)\),

total measure of intermediate-good (machine) varieties, \(t \mapsto N(t)\),

machine varieties \(t \mapsto \{ x(\nu, t): \nu \in [0, N(t)] \}\),

and relative prices \(t \mapsto (r(t), w(t), \{ p(\nu, t): \nu \in [0, N(t)] \})\),

such that:

Households optimize:

Firms maximize profit

Free-entry condition:

Markets clear:

Let’s do a bit more work with the equilibrium definition to gain more insights.

Note that (14.13) implies that the price of each intermediate good (machine) is constant:

Acemoglu [1] normalizes \(p \equiv 1\).

Using this in the demand for machines by the final-good firm (14.10), we can see that the equilibrium demands for machine varieties are also constant and proportional to the (workforce) population size:

The equivalence with the last term above is a result of normalizing \(p \equiv 1\) and \(A = 1/(1-\beta)\).

Exercise 14.8

Show that intermediate-goods-producers’ profits also exhibit the same insight:

for all varieties \(\nu\).

Exercise 14.9

Show that the aggregate employment of intermediate inputs (lab machines) in equilibrium is

and aggregate output is

Observe that equilibrium aggregate output features constant returns to labor input \(L\) alone, but has increasing returns to both \(N(t)\) and \(L\).

From a mechanistic perspective, this looks like an \(AK\)-style model. There is an important difference though: Instead of assuming linearity of aggregate production in physical capital \(K\)—i.e., a primitive assumption in \(AK\) growth models—here, we have constant returns to scale at the private firm level but increasing returns in the aggregate. That is, this is an equilibrium determination of an “\(AN\)” growth condition.

Exercise 14.10

We have just shown that the average product of labor \(Y(t)/L\) is increasing in intermediate-goods variety \(N(t)\). Why?

The aggregate production function for the final good in Equation (14.6), by assumption, exhibits diminishing (private) returns to \(M(t)\); so what keeps the equilibrium from hitting diminish returns and the average product of labor from becoming constant?

Surely, each intermediate good is claiming scare resources (the final good) in its production? Perhaps not, if somehow, the final good keeps growing or equivalently, the marginal product of \(M(t)\) does not tend to zero. Why not?

The answer lies in the following equilibrium derivation. Show that

Interpret this condition.

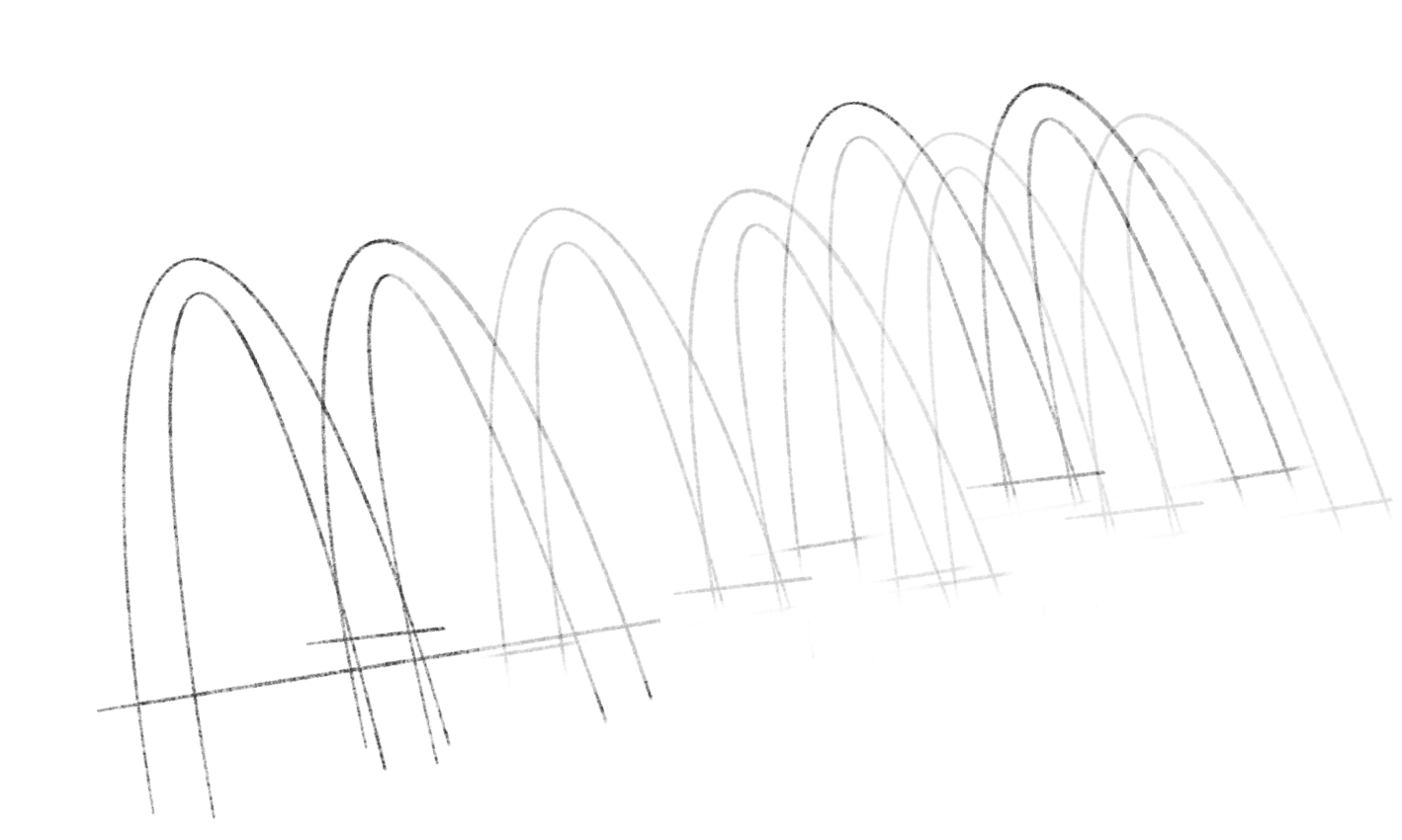

Let \(m(t) := M(t)/L\). Now, illustrate the marginal product of \(m(t)\)—i.e., \(y' \equiv d [Y(t)/L]/dm(t)\). Show that for fixed \(t\) and \(N(t)\), this implies a downward sloping marginal product curve in \((m, y')\)-space. What happens as \(N(t)\) grows? Explain.

Also, show that the price of the input \(M(t)\) is decreasing with \(N(t)\):

What can you conclude about the mechanism here that keeps diminishing returns to \(M(t)\) at bay?

14.3.1.7. Balanced-growth path#

The model has no transition dynamics:

Exercise 14.11

Use the free-entry condition (14.18) and your result that intermediate firms’ profits are constant—(14.21)—along with the flow or HJB definition of the firms’ equilibrium market value.

Show that the real interest rate is time-invariant:

Since \(r(t)=r\) is constant, equilibrium consumption–which must also be optimal for households by Equation (14.3)—must grow at a constant rate:

That is, any equilibrium transition is immediately on an equilibrium balanced growth path.

How to determine the level of \(c(t)\)?

Exercise 14.12

\(Z(t)\) can be determined from (14.20).

Using this in (14.17), show that the equilibrium is summarized by a partially-coupled differential equation system in \((N, C)\):

Again, we see the same mechanical form as an \(AK\) model here.

Exercise 14.13

Assume parameters such that \(r > g\).

Show that the jump variable is determined by the state-feedback rule:

and that

The balanced-growth path will feature:

Exercise 14.14

In constructing the equilibrium above we have assumed that the expected profit from R&D is sufficiently large to overcome the fixed cost of R&D investment—see Equation (14.18).

Show that if \(\eta\beta L > \rho\), then there is no entry to R&D, and that the aggregate economy stays at a constant level of living standard equal to \(Y(0)/L = N(0)/(1-\beta)\).

14.3.1.8. Model implications#

From the equilibrium deductions above we can see that:

There are scale effects: Equilibrium growth rates depends on the size of the country.

Exercise 14.15

Do you think this is supported in the data?

Why or why not?

Discuss.

There are no transitional dynamics: If there is profitable entry to R&D, the economy jumps immediately onto the positive-growth BGP.

14.3.1.9. Planner’s efficient allocation#

Read Acemoglu [1].

Exercise 14.16

Construct a benevolent social planner’s allocation or optimal control problem.

Show that the social value from R&D is larger than that induced by the competitive equilibrium with free and positive entry to R&D. Therefore, also show that the economy would have grown faster under the planner’s allocation compared to the market solution.

Intuitively, there are two reasons contributing to an inefficient competitive equilibrium with R&D:

An intensive margin effect: Since intermediate-good firms are monopolistic, there is a pricing-quantity distortion. This renders output inefficiently lower than what the planner—our stand-in for society—prefers.

An extensive margin effect: Only successful innovators earn monopoly profits and the deadweight loss from innovation is internalized these firms. As a result, the number of invented varieties is inefficiently lower in a competitive equilibrium.

14.3.1.10. Role for policy intervention#

The failure of the first welfare theorem here suggests that there might be a role for corrective policies.

There are two distortions requiring two policy instruments:

Subsidies to R&D to directly incentivize investment in creating new product varieties.

Subsidies to intermediate inputs in creating new product varieties to induce intermediate producers to produce intermediate goods at the socially efficient level.

14.3.2. Knowledge spillovers model#

In Romer [26], ideas are produced using scarce resources—human capital employed in R&D.