15. Endogenous Growth, Misallocation and Growth Accounting Revisited: R&D II#

15.1. Some background#

Recall in the original Solow growth accounting exercise, much of cross-country living standard inequality was accounted for by disparities in TFP between countries.

Traditionally, authors have argued that frictions to technology sharing or diffusion explains differences in these TFPs.

Hsieh and Klenow [11] revisited this insight by arguing instead that much of TFP differences can be accounted for by misallocation. That is, by the inefficient use of technologies in certain countries, e.g., state-owned enterprises, markups due to market power, red-tape, and etc.

The authors measure misallocation by identifying gaps in marginal product, assuming competitive markets and the neoclassical production function model as the benchmark for measurement. The idea is that if there is no misallocation, even if firm-level TFP may vary across firms, the total factor revenue productivity (TFPR)—i.e., firm-level TFP times its product price—should be constant. That is, more productive firms charge proportionately lower prices if they were perfectly competitive.

With distortions or “misallocation”, TFPR can be dispersed across firms. They showed that there is more dispersion in firm-level TFPR (relative to aggregate TFPR) in China and India, when compared with the U.S. That is, there is “misallocation”, and that accounts for about half of aggregate TFP differences. In their measurement exercise, Hsieh and Klenow [11] treated these gaps as exogenous sources of inefficiency or wedges.

What then accounts for these wedges?

That is, what might be the causal link between these arguably endogenous elements:

industry competition,

entry-exit dynamics of firms,

the distribution of markups and misallocation,

and, aggregate growth and TFP differences across countries?

15.2. R&D, heterogeneous markups, and misallocation#

Peters [19] enters the stage: He proposes a means of reconciling these elements into a framework that helps us unpack and (partially) account for the exogenous measures of misallocation.

15.2.1. Bird’s-eye view#

Let’s take a helicopter survey to appreciate the overall logical arc in this paper. We’ll also flag a few key variables that we’ll need to look out for later.

The model presented here (and in the main article of Peters [19]) is a simplified version of the Schumpeterian or creative-destruction model of Klette and Kortum [14].

The added twist is to allow firms to innovate and improve their productivity or lower their cost, in order to “stay ahead of the competition” and earn monopoly markup rents.

To rationalize markups in a tractable way, the author focuses on Bertrand competition where demand exhibits perfect substitutability across competing sellers within an intermediate good market or product variety.

The pricing equilibrium is a standard Industrial Organization result of limit pricing: The lowest (marginal) cost firm serves the entire market and charges a price equal to the second-lowest marginal cost of all rival firms.

This new mechanism in the model renders two opposing forces.

There is the original “creative-destruction” force: Entry of rivals into a product category and limit pricing means (initially) an incumbent firm cannot charge a high markup. Entry into a new product category/market is costly. A new incumbent is one whose higher-quality product would have replaced a previous incumbent’s product of a lower quality. (Qualities are ordered by deterministic step size \(\lambda>1\).)

There is also the new “own-innovation” channel: By making a costly investment to lower its marginal cost, an incumbent can afford to deter entry of rivals (new firms or territorial expansion of existing firms) into a product category.

The model is somewhat block recursive and is thus tractable:

Static conditions:

Conditional on the number of firms and the distribution of firms’ productivity at any point in time, we can derive equilibrium limit-pricing results and hence, employment, markup, and firm profit for each product variety.

Given cross-sectional, marginal distributions of firm productivity and markups, we can construct aggregate employment, real wage, markups, and hence have a clean model-based identification of the misallocation wedge \(M\).

Dynamic conditions:

The dynamic choices of each firm, over its own-innovation rate (\(I_{i}\)) and product-expansion (entry into a new product market) rate (\(x_{i}\)), do not depend explicitly on the aggregate distribution of firms. They depend only the current number of product varieties it owns and the list of “quality gaps” between an incumbent and its nearest competitor over all its product lines. There is a closed-form solution to a firm’s Hamilton-Jacobi-Bellman equation.

The total rate of creative destruction \(\tau\) will depends on the rate of entry by new entrants (\(z\)) and on the total rate of expansion by existing firms into other product varieties (\(I\)).

The evolution of the cross-sectional distribution of firm markups has a closed-form solution and depends on the measures of products featuring certain quality gaps. These measures satisfy a system of linear ODEs. The long-run distribution of markups is Pareto and the Pareto coefficient depends on an endogenous statistic \(\theta\), which in turn depends on \(\tau\), \(I\), and \(\lambda\).

The model generates these equilibrium properties:

There is a unique stationary distribution of markups that has the Pareto form. On one hand, the creative-destruction channel (\(\tau\)) tends to compress the distribution of markups as new firms replace old ones and keep monopoly power in check. On the other, the own-innovation channel (\(I\)) tends to slow down entry and incumbents in each market have more time to grow and expand their markup power. This tends to “fatten” the Pareto tail.

The endogenous Pareto tail fully determines the aggregate TFP (\(Q \times M\)) and labor share (\(\Lambda\)). In a balanced growth path, a higher churning intensity (\(z/I\)) is associated with a lower misallocation, a higher aggregate TFP and a higher share of labor income in total income.

The model also implies the following testable predictions.

Life-cycle of product markups: At the product level, markups increase stochastically, conditional on firm survival. For a vast majority of firms, the “own-innovation channel” can be shown to dominate the “creative-destruction channel”.

This is consistent with empirical evidence of average markups and firm size both increasing in the age of firms.

When calibrated to panel data on Indonesian firms, the model suggests that 15% of measured dispersion in marginal products (or TFPR) is accounted for by markups. If markups were the only source of misallocation, then this implies a loss of 1% in aggregate TFP.

15.3. Model#

Let’s stick with the notation in Peters [19].

For example, a variable \(X_{t}\) denotes the outcome of the function \(t \mapsto X(t)\).

15.3.1. Preferences#

Consumers (households) are homogeneous. There is an infinite, measure-one set of these households. They don’t value labor or leisure, and have a labor endowment of \(1\).

Exercise 15.1 (Easy as, mate)

If you anticipate an equilibrium of this model, how much labor would be (optimally) supplied by each household?

At each moment \(t\), a household consumes a final, composite good \(c_{t}\), and orders the stream of such outcomes using this lifetime utility criterion:

We have the following notation:

\(S_{it}\) is the set of firms competing in a product-market \(i\) at time \(t\).

A firm, indexed by \(f\) is an element of this (endogenous) set.

\(y_{fit}\) denotes the quantity of product \(i\) a consumer purchased from firm \(f\) at time \(t\).

At any moment \(t\), the total quantity of final good demanded (and produced) in the economy is a Cobb-Douglas aggregation of a (fixed) infinite set of differentiated products \(i \in [0,1]\):

Exercise 15.2 (Substitutability within and across product markets)

Try to break Equation (15.2) into two aggregation components. Then explain:

Why are any two product varieties, say \(i, i' \in [0,1]\), considered imperfect substitutes?

Why, for a given market or product variety \(i\), is consumer demand for the same product across firms \(f\) considered perfectly substitutable?

Note

This particular preference assumption will provide a tractable characterization of firms’ pricing strategies later.

The consumer problem is very simple: There is really no dynamic choice or trade-off here for us to worry about. Their demands are static and will be characterized by the component demands, \(y_{fit}\) below.

15.3.2. Production#

Firms can produce many varieties of products. They differ in terms of a product-specific level of productivity, denoted as \(q_{fi}\).

A firm \(f\) hires \(l\) units of labor and transform it linearly into good \(i\):

Note

We drop the \(t\) index here as the allocation problems over varieties \(i\) and firms \(f\) will be static.

15.3.3. Static allocations: Pricing equilibrium and misallocation#

Peters [19] jumps the gun a bit here to preview an aspect of equilibrium: The purpose is to do some (solution) housekeeping by first pinning down the (static) pricing equilibrium.

Suppose at any time \(t\) and in any market \(i\), there is a set of (heterogeneous) firms competing with each other.

For any given market \(i \in [0,1]\), Peters [19] uses the notation

\([S_{it}]_{i}\) for the set of competing firms; and,

\([q_{fit}]_{fi}\) for the set of firm productivities, where \(f \in [S_{it}]_{i}\).

Note

A priori, the distribution over the sets, \([S_{it}]_{i}\) and \([q_{fit}]_{fi}\), and the sets themselves, should be relevant state variables.

These evolve endogenously via the:

entry of new firms into the economy;

expansion of existing firms into new markets; and

productivity gain by current firms in markets they already serve.

The earlier paper by Klette and Kortum [14] had considered 1 and 2.

Peters [19] adds own-innovation and pricing competition in currently-served markets to generate heterogeneity in markups.

This will connect between the three outcomes of growth, misallocation and firm dynamics.

Exercise 15.3 (Demand structure)

Why did Peters [19] assume that the demands for product varieties \(i\) are perfect substitutes?

What modelling convenience does this deliver? (Consider the pricing problem of each incumbent firm.)

Since the following characterizations are static, then we can drop the explicit dependency of variables on \(t\).

15.3.3.1. Bertrand pricing equilibrium and market (\(i\))-level outcome#

This is the new twist in Peters [19].

From above, we know firms face constant returns to scale but differ in their product quality or productivity \(q_{fi}\).

Therefore, they are heterogeneous in their marginal cost, which is \(w/q_{fi}\), and \(w\) is the real wage rate.

Exercise 15.4 (Micro 101!)

Explain in words why any firm \(f\) in market \(i\) has marginal cost given by the formula \(w / q_{fi}\).

Consumers view different firms as perfectly substitutable in any given market \(i\).

Now denote:

\(q_{i}\) as the quality/productivity of the (currently) most efficient firm in market \(i\); and,

\(q^{F}_{i}\) as the quality/productivity of the (currently) second-most efficient firm (or the “Follower”) in market \(i\).

We can then reason through the following equilibrium where firms compete in prices:

Proposition 15.1 (Bertrand pricing equilibrium)

The most efficient firm (i.e., with the lowest marginal cost) serves the entire market and charges a limit price equal to the marginal cost of the second-most efficient firm.

Exercise 15.5

Show the following for each market \(i\):

15.3.3.2. Firm (\(f\))-level allocations#

Also, let \(N_{f}\) be the set of products a firm \(f\) produces.

The cardinality of \(N_{f}\), denoted as \(n_{f} = |N_{f}|\), gives us the number of such products.

Exercise 15.6

Show that we can account for the total employment in firm \(f\) as:

One measure of the size of a firm \(f\) is its employment, \(l_{f}\).

Exercise 15.7 (Variety, markups and firm size)

Firm size, \(l_{f}\), depends on two factors:

The number of product variety produced. How?

Its markups, conditional on \(n_{f}\). How?

15.3.3.3. Aggregate allocations and misallocation#

Let’s switch our \(t\)-dependency in notation back on again.

Suppose for now, we know that at any time \(t\), the aggregate or cross-sectional distribution (c.d.f.) of

markups is \(G_{t}(\mu)\); and

firm productivity is \(H_{t}(q)\).

The total measure of workers hired in goods production is thus

where \(G_{t}(\mu)\) is the cross-sectional distribution of markups at time \(t\).

Since \(Y_{t}\) is the numéraire good, we can do the following:

Exercise 15.8

Show that

where \(\ln(Q_{t}) = \int \ln(q) dH_{t}(q)\) and \(H_{t}(q)\) is the distribution of productivity \(q\).

Economy-wide output is thus

Note

Aggregate misallocation and TFP

The term \(Q_{t}\) is the exponential of the (CES) aggregate efficiency index.

The term \(M_{t} \leq 1\) is the degree of economy-wide misallocation (here, solely due to market power).

Their product \(Q_{t}M_{t}\) is the model’s measure of aggregate labor productivity (i.e., its aggregate TFP).

Exercise 15.9 (Aggregate misallocation)

Why is \(M_{t} \leq 1\)?

What does it mean when \(M_{t} = 1\) or when \(M_{t} < 1\)?

We can also derive the implication for labor’s share of total income as:

Note

Here’s our “macro” takeaway message from the static part of the overall equilibrium:

Higher markups are contemporaneously related with a lower labor share of income, as markups

The micro, firm-level market power here has only a static misallocation effect on the macroeconomy.

More generally (i.e., if the final-good aggregator were a general CES function), the misallocation measure \(M_{t}\) can depend on the joint distribution of markups and firm productivity. (This is dealt with in Section 2.7 of Peters [19].) Here, in the Cobb-Douglas final-good aggregator case, it only depends on \(G_{t}(\mu)\).

15.3.4. Dynamic parts#

Previously, we previewed “equilibrium” in terms of its static properties. In doing so, we took the (joint) distribution of firm productivity and markups as given at any point in time.

Our remaining task is to pin down the dynamic bits of the model’s equilibrium.

Anticipating the limit pricing equilibrium in each time \(t\), we now can focus attention on solving, for each market \(i\), its dominant firm’s dynamic investment problem.

A firm that serves an existing market \(i\) gets to make the following decisions on the flow rates of

investment in own innovation, \(I_{it}\), and

expansion into a new product space \(i'\), \(x_{it}\).

We can find these by solving for the firm’s value function \(V_{t}(\cdot)\), by utilizing our lessons on Bellman’s principle of optimality.

A potential entrant firm can also threaten an existing firm in an existing market it serves.

Note

Cannibalism served two ways:

We shall see that the total rate of “creative destruction” (\(\tau_{t}\)) will be the sum the flow rate of new entrants \(z_{t}\) and the total product expansion rates across all existing firms.

What that also means is that an existing firm would have to take that into account in its optimal control problem.

Once we have solved each firm’s optimal control problem, and taken into account a free-entry condition, we can do some flow accounting to analytically construct the dynamics of the distribution across firms.

15.3.4.1. Firm HJB equation#

Consider first how the product-specific efficiency of a firm relates to markups.

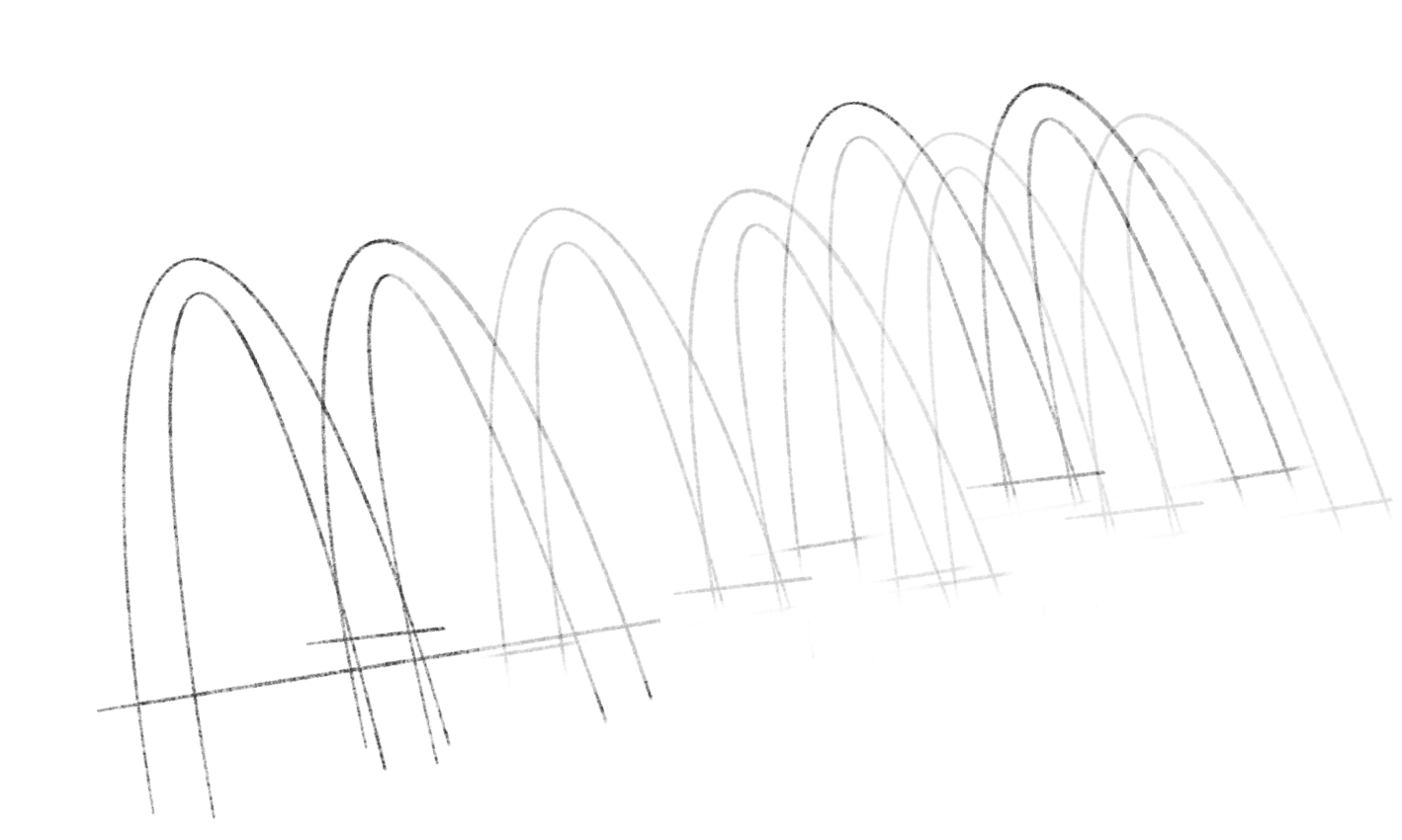

There is a quality-ladder on which firm’s efficiency at producing a product \(i\) is ordered. Imagine a ladder, where a rung on it is indexed by \(r\).

Assume \(r > 1\) and deterministic. (This can be generalized to be a random variable.)

Firm efficiencies or qualities are ordered according to the

This assumption buys us a convenient relationship between markups in equilibrium and the quality (efficiency) gap between an incumbent and a follower firm.

Exercise 15.10 (Markup and quality gap)

Verify that

where \(r_{it}\) and \(r^{F}_{it}\), respectively, are the rungs on the quality ladder of the firm that captures market \(i\) and the second-lowest marginal cost firm (the “Follower”).

Note

Here, because of the Bertrand limit pricing result, \(\Delta_{it}\) will turn out to be a payoff-relevant statistic for a firm’s optimal control problem.

There is a one-to-one mapping between the productivity gap \(\Delta\) and equilibrium markup \(\mu\).

Exercise 15.11 (Think)

Why did we not use \(f\) indexing in the variables just above? That is, does a specific firm identity \(f\) matter here? Why, or why not?

How does the current productivity of product \(i\), \(q_{it}\) improve?

Note

Birth and death process

Assumption. There are three channels of growth:

(\(I\)): Own-innovation by incumbent firms;

Creative destruction:

a. (\(x\)): Expansion by creative destruction to replace other firms; and,

b. (\(z\)): New entrants replace existing firms.

All three channels improve \(q_{it}\) by a single step to \(\lambda q_{it}\).

However, they have different implications for markup:

Own-innovation increases productivity gap from \(\Delta\) to \(\Delta + 1\). All else constant, this means markup increases by a factor of \(\lambda^{\Delta+1}/\lambda^{\Delta} = \lambda > 1\)

Creative destruction—by (a) expansion of territory, or (b) new entrants—decreases productivity gap from \(\Delta\) to \(1\), and so markup falls by a factor of \(\lambda^{\Delta}/\lambda^{1}\).

The Poisson rates \(I\) and \(x\), respectively, govern the survival of a firm and its “birth” into a new product market. The latter also contributes to the rate of death of other incumbents. The rate \(z\) governs the birth of new entrants and contributes to the death rate of incumbents.

Herein lies the rub for a firm.

Note

Dynamic trade-off for a firm

Effect 1 is contra-competition while Effects 2(a) and 2(b) are pro-competition.

One on hand, a firm wants to invest in improving an existing efficiency of making a given product. Success here means immediate greater market power and being able to survive or “stay ahead of the competition.”

One the other, the firm must worry about its future markups and profits that can arise if it were to expand to a new product space. The immediate cost is to take in reduction in markup since getting into a new product means starting at its lowest quality rung. The expected future profit from expansion may accrue if the firm survives being overtaken by others in the new product space.

Exercise 15.12 (Payoff-relevant states)

Verify that the vector of state variables relevant to a firm is sufficiently given by:

\(n\), its number of existing products (markets) it makes (serves); and,

\([\Delta_{i}]\), the list of quality gaps in making all products it current serves.

A firm’s HJB equation is as follows:

Observe that on the left is the flow value of the firm. It consists of four parts:

Flow profits that are optimal: They are evaluated at the (static) Bertrand limit pricing equilibrium derived earlier.

Capital gain: The firm’s flow value could increase due to an increase in its market value over time.

Creative destruction: The firm could lose its hold on any of its \(n\) existing markets to other (new entrant or existing expanding) firms. It takes the (equilibrium) arrival rate of destruction \(\tau_{t}\) as given.

Option value: Pay an innovation cost now in expectation of a gain in total future profits via maintaining incumbency in a market and via expansion into a new product market.

Exercise 15.13 (Trivia)

True or False? The cost function \(\Gamma\) returns a cost measured in units of the numéraire good.

The following assumption on cost, together with the observation that the payoff is linear in the list \([x_j, I_j]\), allows for a closed form solution for the unknown value function \(V_{t}\):

where \(\varphi_{I}, \varphi_{x} > 0\) are cost shifter parameters, and \(\zeta>1\) ensures a (strictly) convex cost function. This guarantees that the HJB would have a unique solution for \(V_{t}\). Note that the assumption of the term \(\lambda^{-\Delta}\) implies that a firm with a bigger efficiency gap faces a lower cost of own-innovation.

15.3.4.2. Free entry#

To pin down the arrival rate of new entrants into a single market, we have the free entry condition:

Note:

The relevant states for a new entrant is \(n=1\) and \([\Delta_{i}] = 1\), since a brand new firm is assumed to have only one product to make and its quality gap is unity.

New entrant have a linear technology that converts a unit of labor hired into a flow of \(\varphi_{z}\) marketable ideas. Thus, its entry cost is the right-hand-side term. The benefit is the value of the firm in the market.

Assume the interesting case of positive entry, \(z > 0\), so (15.16) holds with equality.

Given the solution \((V_{t}, x_{it}, I_{it})\) to the HJB equation (15.14) and the free-entry condition (15.16) binding to give us \(z_{t}\), we can determine the endogenous creative-destruction arrival rate as:

15.3.5. Balance-growth (stationary) equilibrium#

Now we are ready put to it all together.

Labor market clearing requires:

Exercise 15.14

Can you explain in words the accounting condition above?

It can be shown that there is a closed-form, unique stationary (balanced-growth-path) equilibrium.

Proposition 15.2 (Unique stationary equilibrium)

Assume that \(\rho > \frac{\zeta-1}{\zeta}\left(\frac{1}{\zeta}\frac{\varphi_{x}}{\varphi_{z}}\right)^{1/(\zeta-1)}\).

There is a unique stationary equilibrium where

The value function solving (15.14) is given by the formula:

(15.18)#\[ V_{t}(n, [\Delta_{i}]) = nV_{t}^{P} + \sum_{i=1}^{n}V_{t}^{M}(\Delta_{i}), \]where

\[ V_{t}^{P} = \frac{\pi_{t}(1) + (\zeta-1)\frac{x^{\zeta}}{\varphi_{x}}w_{t}}{\rho+\tau}, \]and, for each \(i = 1, ..., n\),

\[ V_{t}^{M}(\Delta_{i}) = \frac{\pi_{t}(\Delta_{i})-\pi_{t}(1)+(\zeta-1)\lambda^{-\Delta_{i}}\frac{I_{i}^{\zeta}}{\varphi_{i}}w_{t}}{\rho+\tau}. \]The optimal investments (arrival rates) are constant: \(([I_{it}, x_{it}], z_{t}, \tau_{t}) = (I, x, z, \tau)\), with

(15.19)#\[ x = \left(\frac{\varphi_{x}}{\varphi_{z}}\frac{1}{\zeta}\right)^{\frac{1}{\zeta-1}}, \]and,

(15.20)#\[ I = \left[ \frac{\lambda-1}{\lambda(\rho+\tau)} \left(\frac{\varphi_{I}}{\zeta}\frac{Y_{t}}{w_{t}} - \frac{\zeta-1}{\zeta}I^{\zeta}\right) \right]^{\frac{1}{\zeta-1}}. \]The distribution of markups is stationary. (We discuss this distribution below.) This implies that the equilibrium wedges \(M\) and \(\Lambda\) are constant.

All variables grow at the constant rate

(15.21)#\[ g = \frac{\dot{Q}}{Q} = \ln(\lambda) \times (I + x + z). \]

Exercise 15.15

(For the keen student.) See if you can derive the equilibrium value function. Use a guess-and-verify method.

Exercise 15.16

Interpret the terms \(V_{t}^{P}\) and \(V_{t}^{M}\) that make up the equilibrium value function \(V_{t}\).

Exercise 15.17

Interpret and comment on the equilibrium behavior in terms of \(I\) and \(x\). What does that mean for the total rate of creative destruction \(\tau\)?

15.3.5.1. Stationary equilibrium: distributional effect#

The distribution of markups is an equilibrium object.

We can describe the evolution of the distribution of markups through the evolution of the measures making up the distribution of quality gaps.

Let \(\nu_{t}(\Delta)\) denote the measure of products with quality gap \(\Delta\) at time time \(t\).

Put on your accountants’ cap and start taking stock of “where the beans flow”.

Given equilibrium behavioral solutions \((I, x, \tau)\), the measures \(\{\nu_{t}(\Delta)\}_{\Delta=1}^{\infty}\) satisfy a system of ODEs:

Exercise 15.18 (Expliquez, s’il vous plait.)

Please put into words your accounting process above, which translates into the ODE system.

We can write this more compactly as:

There’s still a bit more algebra to be done. However, the flow accounting of the distribution of markups above will take us to this insight.

Proposition 15.3

Given a stationary equilibrium own-innovation and creative-destruction arrival rates \(I\) and \(\tau\), we can define the statistic:

We can derive the stationary distribution of markups as

\[ G(\mu) = 1 - \mu^{-\theta}. \]Aggregate misallocation can be computed as

\[ M = e^{-1/\theta}\frac{1+\theta}{\theta}, \]and labor share as

\[ \Lambda = \frac{\theta}{1+\theta}. \]

Given the parameter \(\lambda\), we can see that the churn rate \(\vartheta = \tau/I\) summarizes the two main forces at work: creative destruction versus staying ahead of the competition.

The resolution of these two forces in equilibrium shape the tail of the Pareto distribution of markups and hence the aggregate measures of misallocation \(M\) and \(\Lambda\).

Exercise 15.19

All else constant:

How does a higher rate of creative destruction relative to own innovation, \(\vartheta = \tau/I\) affect the Pareto tail of \(G(\mu)\)?

How does that affect misallocation in the economy?

Exercise 15.20 (Deriving the markups distribution)

Read the appendix of the paper.

Can you explain in words the logical steps taken in going from the flow accounting of the measures \(\{\nu_{t}(\Delta)\}_{\Delta=1}^{\infty}\) above to deriving the markups distribution \(G(\mu)\)?

In the rest of the paper, Peters [19] also show us the following:

Life cycle (by firm age):

Firm-level or product-level markup dynamics.

Firm survival.

Aggregate misallocation \(M\) and labor share \(\Lambda\).

Accounting for “misallocation”: Calibrated study using Indonesian firm-level panel data.