12. Neoclassical Growth#

Now we’ll put Pontryagin’s Maximum Principle (PMP) into action. We will study the Ramsey model of optimal accumulation and its application to economic growth (Cass-Koopmans).

We’ll do a little switch of notation here:

What was the momentary payoff function \(h\) is the last chapter will now be called \(u\) (for utility).

We will now repurpose \(f\) (the mapping for the controllable dynamical system) as the neoclassical production function.

We will reassign the control function \(u\) to \(c\) (for consumption) now.

Roadmap

Section 12.2: We’ll begin with the benchmark first-best allocation problem of a hypothetical benevolent social planner. This is our Pareto optimum against which all other market solutions (competitive equilibria) will be compared.

Section 12.3: Then we move closer to something we see in the so-called “real world”: Market (relative) prices as the mechanism for allocating resources. We will model this using the competitive equilibrium solution concept you would have learned in your microeconomic theory class.

Section 12.4: We’ll make a connection between the planner’s allocation and the competitive equilibrium allocation. We will see the idea of duality at work in this model. What is optimal for the planner can also be implemented through competitive equilibrium. This is convenient here since if we were to solve for a competitive equilibrium, it would be easier to solve the planner’s problem and then work backwards to retrieve the corresponding market prices that support the same allocation!

Section 12.5: The basic insights in the model without growth is repeated for the case with population and productivity growth. This only requires some algebraic adjustments to de-trend variables than will continue to grow in the long run to ensure there is a well-defined balanced growth path or BGP.

Along the way we will also study the dynamic behavior of this model. We will use this to deduce a few thought experiments with the model. The exercises here are important: Do them to get a firm understanding of this material!

12.1. Model primitives and background#

Everything about this model is identical to our Solow-Swan model in Section 9.1. Consider first, the version without population and TFP growth.

The only exception is in how we model the representative household’s consumption/saving behavior.

Here we go one level deeper, and in fact, backwards in time to Ramsey’s 1928 paper.

In what follows, we will solve an infinite-horizon version of this model: \(T \rightarrow \infty\).

Objective function. Fix a control \(t \mapsto c(t)\). The discounted lifetime value of a representative agent’s objective function induced by the function \(c\) is

with \(\rho > 0\) being the agents’ subjective rate of time preference. Without loss of generality, we have set \(t_{0} = 0\).

We assume that the instantaneous utility function \(u\) is twice continuously differentiable, strictly increasing and strictly concave: \(u'>0\) and \(u''<0\). Also, \(u\) satisfies the Inada conditions: \(\lim_{c \rightarrow 0}u'(c)=\infty\) and \(\lim_{c \rightarrow \infty}u'(c)=0\).

Controllable dynamical system. The flow resource constraint in terms of per-person capital stock is:

where \(f(k(t)) - \delta k(t)\) measures the net flow of resources at time \(t\) (output minus depreciation of capital). For a fixed control function \(c\), the net resource less outcome \(c(t)\) would give us the rate of change in capital stock, \(\dot{k}(t)\), which propels \(k(t)\) into a new position \(k(t')\) instantaneously. (Think of \(t' = t + \lim_{\Delta t \rightarrow 0}\Delta t\).)

12.3. Competitive equilibrium#

The characterization of the optimal allocation in the last part was one that requires a benevolent, dictatorial solution.

What if—as in the real world—there is no such hypothetical social planner? That is, the allocation of resources over time in this model can only be implemented through some market pricing mechanism?

A good starting point or benchmark is the neoclassical or Walrasian narrative of markets. The solution concept here is what you have learned in a previous microeconomics course: competitive equilibrium or general equilibrium.

12.3.1. An ownership structure#

Suppose the identical households:

own claims \(a(t)\) to capital stock, \(k(t)\);

rent \(k(t)\) to firms.

Alternatively, we can assume firms own \(k\) and households hold equity ownership in firms. Or, we can assume debt financing of firms—i.e., firms borrow from households in order to purchase \(k\).

It turns out all three of the above structures are the same since we have a pristine or frictionless world here. This is a consequence of the famous Modigliani-Miller Theorem of corporate structures.

12.3.2. Household OCP#

Households buy the final good from firms in the goods market, and rents out their labor and capital services to firms in the labor and capital markets.

Let \(t \mapsto (w(t), r(t))\), respectively, now denote the real exchange rate between labor and the final good, and, between capital services and the final good. That is, these relative pricing functions are measured in units of \(c\).

Households take the factor-pricing outcomes \((w(t), r(t))\) as parameters.

Household labor supply is inelastic and the aggregate labor supply is one.

Recall, all these assumptions are just like in the competitive equilibrium setting of them Solow-Swan model.

(We may imagine there is a contingent-claims market trading in individually issued securities. However, since households are identical, there is no need to borrow or lend from each other, so then the assets are in zero net supply.)

The household’s OCP is:

Again, assume that preference representation \(u\) has a CRRA(\(\sigma\)) form.

Intuitively, for a competitive equilibrium and therefore, optimal behavior of households, we need to rule out the possibility that households may borrow indefinitely. This restriction on the equilibrium is sometimes referred to as a no Ponzi game condition, named after the famous con-artist Charles Ponzi. To derive this, suppose the date \(t\) price of consumption is \(p(t)\).

In terms of the real return on assets, \(r(t)\), no arbitrage means that

or equivalently, the rate of return on foregoing future consumption in favor of the immediate must equal the opportunity cost associated with forgone return on productive capital:

The no Ponzi game requirement is as follows. Asymptotically, households’ net claims on assets (here, capital) cannot have a negative present market value:

Exercise 12.4 (Household Problem)

Write down the present-value Hamiltonian associated with the OCP above.

Show that given \(k(0)=k_0\), the necessary conditions for optimal household behavior (saving) are:

and,

along with the household no-Ponzi-game restriction (12.14).

12.3.3. Firms#

Firms are perfectly competitive, operate a constant returns to scale production function \(f\) and maximize profits.

Profit maximization is described by the necessary and sufficient conditions

and

12.3.4. Solution/equilibrium concept#

Definition 12.1 (Competitive equilibrium)

Given \(k(0)=k_{0}\), a competitive equilibrium is an allocation or trajectory \(t \mapsto (c,k)(t)\) such that:

12.4. Fundamental welfare theorems and duality#

Exercise 12.5 (FWT #1)

Compare the planner’s PMP and the competitive equilibrium.

Show that the optimal planning problem and the market allocation through competitive equilibrium yield the same allocative solution.

12.5. TFP and population growth#

Suppose now population grows at rate \(n\):

Assume technical progress is Harrod neutral and this grows at rate \(g\):

We now re-define \(c\) and \(k\), respectively, as consumption and capital per efficient unit of workers:

We can easily:

Exercise 12.6 (Resource constraint in efficiency units)

Show that the planner’s (or, equivalently competitive equilibrium) resource constraint is:

Also, assume that \(\rho>n\) and without loss of generality, \(A(0)=L(0)=1\). A planner’s (or a household’s) objective function is given by

Then we can:

Exercise 12.7 (Resource constraint in efficiency units)

Show that the planner’s Hamiltonian is:

Finally, we can:

Exercise 12.8 (Optimal allocation and competitive equilibrium)

Assume that \(\sigma(cA)=\sigma\), a constant.

Show that the social planner’s optimal allocation and the competitive equilibrium allocation both satisfy the equations:

and,

and the initial value of the state and the transversality condition:

Exercise 12.9 (BGP preference restriction)

Prove that in order for there to be a balanced growth path where \((k,c)(t)\) converges to constants \((\bar{c},\bar{k})\), it suffices that the Arrow-Pratt measure, \(\sigma(c(t)A(t))\), must be asymptotically constant.

CRRA preference functions

A stronger assumption that satisfies the last result is to insist that \(u\) belongs to the CRRA class of functions.

In this case, we can:

Exercise 12.10 (CRRA and BGP preference restriction)

Show that the planner (or agents) must be sufficiently patient:

Note that if \(\sigma>1\), this restriction is less stringent that the earlier requirement of \(\rho>n\). Otherwise, it is at least as tight as the requirement of \(\rho>n\).

That is, the requirement of balanced-growth consistent with the Kaldor facts imposes a further restriction on preferences (indexed by \(\rho\) and \(\sigma\)). This is in addition to the restriction that technological progress is to be Harrod neutral or labor augmenting.

Exercise 12.11 (Numerical 👾 💻)

Assume \(f(k) = k^{\alpha}\) and \(u(x) = \lim_{\sigma' \rightarrow \sigma}x^{1-\sigma'}/(1-\sigma')\). Pick some numbers for the model parameters: \(\sigma, \rho, n, g, \delta, \alpha\).

Using a computer and your brain, do the following:

Plot the phase diagram of the optimal allocation in this economy with TFP and population growth: Show the nullclines and vector field.

Construct an appropriate jump in \(c_0 \equiv g(k_0)\), given \(k_0\). Using these, \((k_0, c_0)\) as initial values, solve the pair of differential equations in \((k, c)\) describing the optimal allocation.

Hint: You will have to use an algorithm like the “shooting method”.

Guess an initial jump \(c_{0}'\).

Given \((k_0, c_{0}')\) as initial values solve the pair of differential equations in \((k, c)\) by integrating forward in time in some time interval \([0,T]\) for \(T\) “big enough”. (You may use a modified Euler successive integration scheme such as the Runge-Kutta method.)

Check that your candidate solution \(\left\{(k(t; k_0, c_{0}'), c(t; k_0, c_{0}')): t \in [0,T]\right\}\) converges to the desired steady state equilibrium \((\bar{k},\bar{c})\).

If not, update your guess of the jump,

\[ c_{0}' \gets c_{0}'', \]and, repeat Steps 1 to 3 again.

Otherwise, stop the algorithm.

Plot the solution curve in the same \((k,c)\)-plane. This is your stable arm and also the optimal state-feedback control rule, \(c = g(k)\).

Plot the time path of \(c(t)\) and \(k(t)\).

Plot the time path of \(C(t) = c(t)A(t)L(t)\) and \(K(t) = k(t)A(t)L(t)\).

Comment on your results.

12.2. Social planner’s problem#

The hypothetical planner is an omniscient, omnipresent, omnipotent and benevolent agent.

Reflect …

Ask yourself: Why do economists use this as a benchmark when thinking about having a benchmark or an idealized social-allocation outcome?

Why is this a reference point for a “pristine” world?

12.2.1. Optimal control problem#

The planner’s optimal control problem (OCP) is

Compare this with the finite-horizon OCP earlier in Equation (11.3).

We’ve now jettisoned the end-point constraint on \(k(T)\). Since we now have an infinite time horizon, \(T \rightarrow \infty\), we’ll need to impose a different requirement.

We’ll return to this and address this issue of the “end-point” where there is no end to speak, when we formulate the problem using Pontryagin’s Maximum Principle (PMP) approach.

12.2.2. HJB formulation#

We leave the next exercise to the reader.

Exercise 12.1 (Got the HJB?)

Construct the HJB equation defining the planner’s optimal state-control path. Explain what this says in the context of the example and why this equation has potentially practical usage.

If a state-control path solves the OCP, derive the necessary conditions governing the path’s optimality from the HJB formulation.

(Recall this is just a reformulation (with \(T \rightarrow \infty\)) of your preview homework in Exercise 11.3.)

12.2.3. PMP formulation#

Consider the (present-value) Hamiltonian:

Note that we have economized on notation here: All the variables \((c, k, \lambda)\) are themselves functions of \(t\). That we have written \(c = c(t)\) for example.

Pontryagin’s Maximum Principle (PMP) for this problem is characterized by the following necessary conditions. These turn out to also be sufficient. (Why?)

The adjoint equation is:

The maximality condition is summarized jointly by:

and,

The transversality condition is

The Arrow-Pratt coefficient of relative risk aversion is defined as:

This unit-free object measures how fast marginal utility changes—i.e., how much curvature there is in the function \(u\) or how quickly or steeply \(u'\) varies. By multiplying absolute risk aversion \(u''(c)/u'(c)\) at point \(c\) with the level of \(c\), this renders the risk aversion measure as a unit-free, percentage variation in utility measure.

Note that \(\varepsilon\left(c\right) = 1/\sigma(c)\) also measures the intertemporal elasticity of substitution of consumption across time.

The envelop condition is implied by considering the maximality condition (12.6) and taking growth rates:

and, combining this with maximality condition (12.7) and the adjoint condition (12.5), we get

where \(r = f'(k) - \delta\) is the marginal product of capital net of the capital depreciation rate. This equals the rate of growth in the planner’s shadow price of capital—i.e., the planner’s internal rate of return on capital.

Two further observations ought to be made here about Equation (12.10):

This is often referred to as the Keynes-Ramsey rule. We had utilized the necessary conditions for an optimal intertemporal consumption trajectory. Mathematically, this condition is also known as the Euler-Lagrange (functional) equation.

The planner internalizes and balances the marginal benefit of shifting consumption across time with its attendant marginal cost: The left-hand side of this equation is the (subjectively or \(\rho\)) present-discounted marginal rate of substitution of consumption over an infinitesimally small time interval. The latter equals the growth rate in consumption over that time interval which is then translated by \(\sigma(c)\). The right-hand side is the planner’s production-technology-defined rate of return on capital—i.e., the opportunity cost of consuming now.

Proposition 12.1 (CRRA and consumption path)

Suppose \(\sigma(c)=\sigma\), a constant. Then, rearranging Equation (12.10), we have

From this we can conclude the following.

Impatience: If the subjective discount rate is larger than the opportunity cost of immediate consumption (\(r<\rho\)), then \(c(t)\) is falling over time.

Patience: If the subjective discount rate is smaller than the opportunity cost of immediate consumption (\(r>\rho\)), then \(c(t)\) is rising over time.

Smoothing: If the subjective discount rate equals the opportunity cost of immediate consumption (\(r=\rho\)), then \(c(t)\) is constant over time.

We can now summarize the necessary conditions that a solution to the planner’s OCP must satisfy:

Proposition 12.2 (Planner’s PMP)

Assume that \(u\) is such that \(\sigma(c) = \sigma\). Given an initial state \(k(0)=k_{0}\), a (socially) optimal allocation is a state-control trajectory \((c^{\ast}(t), k^{\ast}(t))\) satisfying:

The Euler-Lagrange (Keynes-Ramsey) condition:

the resource constraint:

and,

the transversality condition (12.8).

We leave here with two observations:

Proposition 12.2 gives us a nonlinear system of differential equations solving for two unknown functions \(t \mapsto (c^{\ast}(t), k^{\ast}(t))\).

However, there are only two boundary values for \(k\). There are none for \(c\). We say \(c(t)\) is a “jump” variable. In solving this system, at an initial \(k(0)\) we’ll need to find an appropriate jump in \(c(0)\). If we found that jump consistent with inducing a trajectory satisfying the optimality conditions, then \(c(0)\) should equal the optimal state-feedback control or rule (say, \(g\)) evaluated at given state \(k(0) = k_{0}\), i.e., \(c^{\ast}(0) = g(k_{0})\).

We won’t solve explicitly for the optimal trajectory here. Instead, we’ll study this qualitatively.

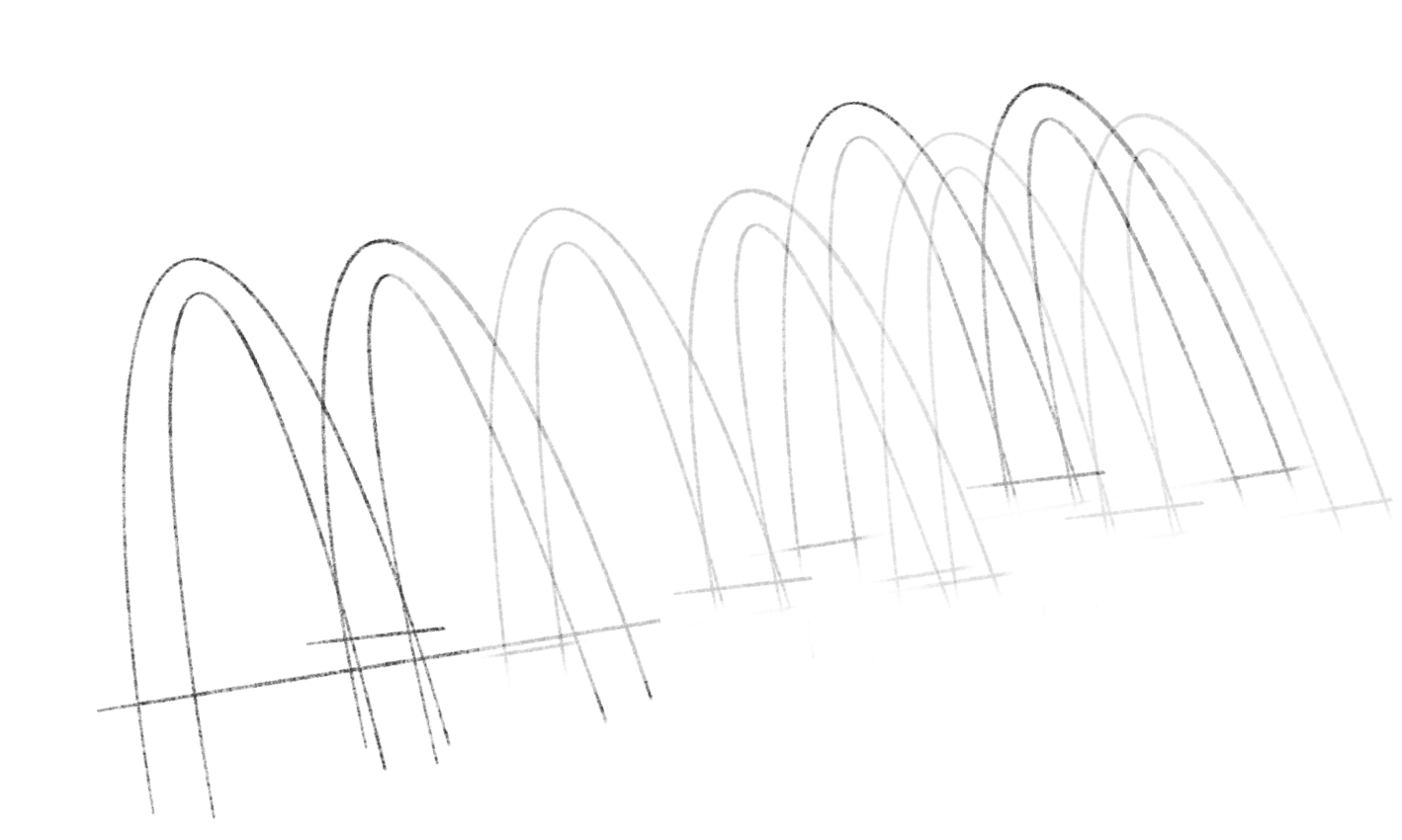

Exercise 12.2 (Ramsey-Cass-Koopmans phase plot)

Draw a phase plane containing coordinates \((k(t), c(t)) \in \mathbb{R}_{+}\)

Define the nullclines induced by (12.12) and (12.13). Sketch the graphs of these respective nullclines.

Hints: Also, show that the \(k\) that maximizes \(c\) along the \(\dot{k}=0\) nullcline (i.e., the “modified golden rule”) in this model is lower than its “golden rule” counterpart from the Solow-Swan setting. To derive this “golden rule”, assume \(c(t) = (1-s)[k(t)]^{\alpha}\) in the Solow-Swan setting, where \(s \in (0,1)\).

Show that the intersection of the nullclines is a steady-state equilibrium point. Calculate or derive the expression of the steady state point \((\bar{k}, \bar{c})\).

Using these nullclines as demarcation lines, work out a few sample elements of the vector field. Deduce that the optimal solution to the planner’s OCP is saddle-path stable.

As a result, deduce that there is a “stable arm”, \(c = g(k)\), where \(g\) is the optimal state-feedback control rule.

Exercise 12.3 (Ramsey-Cass-Koopmans comparative dynamics)

Consider a permanent shock in the form of an increase in \(\rho\).

Using the phase plot earlier deduce what changes in the diagram (in terms of the nullclines).

Then qualitatively work out the transitional dynamics of \(c\) and \(k\) in the phase diagram.

Translate what you have deduced into a time profile for the optimal trajectory under this shock.

Can you deduce what happens to the “marginal propensity to save” in this model, as a result of the shock?

Comment of what you have learned from this model, focusing on how the RCK endogenizes saving decision rules.